Purchase or Refinance:

- No income verification

- No bank statements

- No DTI calculated

- No employment

- No tax returns

- No 1099’s

- No W2’s

Purchase or Refinance:

Property Type:

Purchase or Refinance:

If you are looking to purchase or refinance an investment property, but don’t want to use your personal income to qualify? A DSCR loan from Mortgage-World.com may be the solution!

A debt service coverage ratio (DSCR) loan allows you to finance multiple properties by using each property’s monthly rental income to qualify for investment properties.

The debt-service coverage ratio is an indicator of a company’s financial health, especially those who are highly leveraged with debt. Debt service refers to the cash that is needed to pay required principal and interest of a loan.

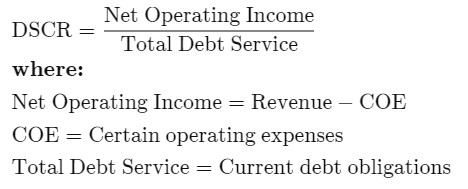

A DSCR loan is calculated by dividing the net operating income (NOI) of the investment property by the debt obligations. Net operating income is certain operating expenses (COE), not including taxes and interest. Most often, COE is considered equal to earnings before interest and tax (EBIT).

DSCR

Total debt service refers to the current debt obligations, meaning principal, interest, sinking fund, an lease payments due in the coming year. A balance sheet will include short-term debt and the current portion of long-term debt.

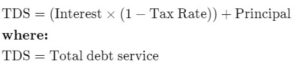

Income taxes may complicate DSCR calculations because interest payments are tax deducible, while principal repayments are not. A more accurate method of calculating total debt service is the following:

DSCR

Mortgage-World.com

Buy a home for the first time with a minimum 500 credit score. Get started today!

Refinance your way to a better mortgage and start saving money now. Apply online!

535 Bergen Blvd. Suite 2

Ridgefield NJ 07657