Should I Choose a Conventional Mortgage or an FHA Mortgage?

Introduction

When it comes to purchasing a home, one of the most critical decisions you’ll face is choosing the right mortgage type. Among the various options available, two popular choices are a conventional mortgage or an FHA mortgage. Each type comes with its own set of benefits and drawbacks, making it essential to understand their differences and suitability for your unique financial situation and homeownership goals. In this article, we’ll explore the key distinctions between a conventional mortgage and an FHA mortgage, empowering you to make an informed decision that aligns with your needs.

Table of Contents

1. What is a Conventional Mortgage?

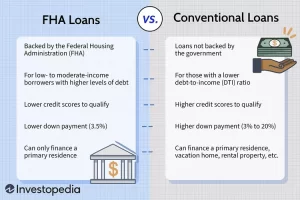

A conventional mortgage is a home loan that is not insured or guaranteed by the government. Instead, it is issued by private lenders, such as banks or credit unions, and follows guidelines set by either Fannie Mae or Freddie Mac, two government-sponsored enterprises. These loans are typically suitable for borrowers with a stable income, good credit history, and a substantial down payment.

2. The Fundamentals of FHA Mortgages

On the other hand, an FHA mortgage is insured by the Federal Housing Administration, which operates under the Department of Housing and Urban Development (HUD). The primary purpose of FHA loans is to make homeownership more accessible to individuals with lower income or credit scores, as they often have more lenient requirements compared to conventional mortgages.

3. Down Payment Requirements: A Conventional Mortgage or an FHA Mortgage

One of the significant distinctions between conventional and FHA mortgages is the down payment requirements. Conventional loans generally require a higher down payment, typically ranging from 5% to 20% of the home’s purchase price. In contrast, FHA loans are more lenient, allowing down payments as low as 3.5%, making homeownership more attainable for first-time buyers and those with limited funds for a down payment.

4. Credit Score Considerations When Choosing a Conventional Loan or an FHA Loan

Credit scores play a crucial role in mortgage approval. Conventional mortgages usually require higher credit scores, often above 620, to qualify for the best interest rates. FHA loans, on the other hand, are accessible to borrowers with lower credit scores, sometimes as low as 580. This makes FHA mortgages an attractive option for individuals with less-than-perfect credit histories.

CALL 888-958-5382 or APPLY NOW!!

5. Mortgage Insurance Comparison When Choosing a Conventional Loan or an FHA Loan

Mortgage insurance is another essential factor to consider. Conventional mortgages require private mortgage insurance (PMI) if the down payment is less than 20%. This additional cost can be a significant consideration for borrowers. In contrast, FHA mortgages mandate both an upfront mortgage insurance premium (MIP) and an annual MIP, regardless of the down payment. While FHA MIP can be more expensive over time, it allows borrowers to qualify with a lower down payment and credit score.

6. Interest Rates: A Conventional Loan or an FHA Loan

Interest rates on mortgages can significantly impact the overall cost of homeownership. Conventional mortgages often offer lower interest rates for borrowers with excellent credit. FHA mortgage interest rates, however, are generally more standardized and less dependent on individual credit scores. Thus, borrowers with lower credit may find FHA loans more favorable in terms of interest rates.

7. Debt-to-Income Ratio Differences When Choosing a Conventional Loan or an FHA Loan

Both conventional and FHA mortgages evaluate borrowers’ debt-to-income (DTI) ratios to determine their loan eligibility. Conventional loans tend to have stricter DTI requirements, typically capped at 43% or lower. FHA loans, on the other hand, may be more forgiving, allowing a DTI ratio of up to 50%. This higher DTI threshold can be beneficial for individuals with higher debt levels seeking mortgage approval.

CALL 888-958-5382 or APPLY NOW!!

8. Property Eligibility with a Conventional Loan or an FHA Loan

Certain property types may be eligible for conventional mortgages but not FHA loans. For instance, FHA loans are commonly used for primary residences, while conventional loans may be more flexible in financing secondary or investment properties. It’s essential to consider the type of property you intend to purchase when choosing between these mortgage options.

9. Flexibility in Loan Terms When Choosing a Conventional Loan or an FHA Loan

Conventional mortgages offer more flexibility in loan terms compared to FHA loans. Borrowers can select from a wide range of fixed-rate and adjustable-rate options, as well as various loan durations. FHA mortgages typically come with fixed-rate terms, limiting borrowers’ options in tailoring the loan to their specific preferences.

10. The Role of the Federal Housing Administration

Understanding the role of the Federal Housing Administration is crucial when evaluating FHA mortgages. The FHA acts as an insurance provider for lenders, reimbursing them if borrowers default on their loans. This insurance aspect allows lenders to offer more lenient terms and lower down payment requirements. The FHA’s mission is to support affordable homeownership for a broader range of Americans.

11. The Pros and Cons of Conventional Loans

Pros:

- Lower interest rates for borrowers with excellent credit

- More flexibility in loan terms

- No upfront mortgage insurance premium

- No property restrictions

Cons:

- Higher down payment requirements

- Stricter credit score criteria

- Private mortgage insurance (PMI) may be required

CALL 888-958-5382 or APPLY NOW!!

12. The Pros and Cons of FHA Loans

Pros:

- Lower down payment requirements

- More lenient credit score criteria

- Assumable loans, which can be transferred to another borrower

- Government backing and support

Cons:

- Upfront and annual mortgage insurance premiums

- Less flexibility in loan terms

- Property restrictions for certain types of properties

13. Choosing a Conventional Loan or an FHA Loan Based on Financial Goals

To determine whether a conventional mortgage or an FHA mortgage is more suitable, consider your financial goals and circumstances. If you have a strong credit history, a significant down payment, and prefer more loan options, a conventional mortgage may be the better choice. On the other hand, if you have a lower credit score, limited funds for a down payment, or are a first-time homebuyer, an FHA mortgage could be the ideal solution.

14. Tips for Selecting the Right Loan: A Conventional Loan or an FHA Loan

- Evaluate Your Financial Situation: Assess your credit score, income stability, and existing debts to understand your borrowing capacity.

- Research Interest Rates: Compare current interest rates for both conventional and FHA loans to find the most favorable terms.

- Consider Down Payment: Decide how much you can afford for a down payment and whether a lower down payment option is more feasible.

- Explore Loan Terms: If you prefer more loan term options, conventional mortgages offer greater flexibility.

- Understand Mortgage Insurance: Compare the costs of private mortgage insurance for conventional loans with the upfront and annual MIP for FHA loans.

- Consult with Lenders: Speak to multiple lenders to gather information and negotiate better terms based on your qualifications.

15. Conclusion for a Conventional Mortgage or an FHA Mortgage

Choosing between a conventional mortgage or an FHA mortgage is a significant decision that can impact your financial future. Each type has its advantages and disadvantages, and the right choice depends on your unique circumstances and homeownership goals. Consider factors such as credit score, down payment, interest rates, and property type when making your decision. By thoroughly researching and comparing both options, you can make an informed choice that aligns with your financial aspirations and sets you on the path to successful homeownership.

CALL 888-958-5382 or APPLY NOW!!

FAQs

-

Is it better to get a conventional mortgage or an FHA mortgage?

The answer depends on your financial situation. Conventional loans are suitable for borrowers with strong credit and a significant down payment, while FHA loans are more accessible to individuals with lower credit scores and limited funds for a down payment.

-

What is the minimum credit score for an FHA loan?

The minimum credit score for an FHA loan can vary, but it’s typically around 580. However, some lenders may require a higher score.

-

Can I get rid of FHA mortgage insurance?

For most FHA loans, mortgage insurance remains for the life of the loan unless you refinance into a non-FHA loan.

-

Are FHA loans only for first-time homebuyers?

No, FHA loans are available to both first-time and repeat homebuyers.

-

What type of properties can I buy with an FHA loan?

FHA loans are commonly used for primary residences, but they can also finance certain approved condominiums and multi-unit properties.

Mortgage-World.com

Comments are closed.