FHA After Chapter 7 Bankruptcy

At least two years must have elapsed since the discharge date of the borrower and / or spouse’s Chapter 7 Bankruptcy, according to FHA guidelines. This is not to be confused with the bankruptcy filing date. A full explanation will be required with the loan application. In order to qualify for an FHA loan, the borrower must qualify financially, have re-established good credit, and have a stable job.

FHA After Chapter 13 Bankruptcy

Similarly FHA will consider approving a borrower who is still paying on a Chapter 13 Bankruptcy if those payments have been satisfactorily made and verified for a period of one year. The court trustee’s written approval will also be needed in order to proceed with the loan. The borrower will have to give a full explanation of the bankruptcy with the loan application and must also have re-established good credit, qualify financially and have good job stability.

In addition FHA loans have been helping people become homeowners since 1934. Therefore a perfect credit score is not needed for an FHA loan approval . In fact, even if you have had credit problems, such as a bankruptcy, it’s easier for you to get an FHA loan than a conventional loan.

Therefore new FHA policy requires a minimum credit of 500 to buy a house. In the old days FHA did not require any credit score. These changes went in to effect in 2010.

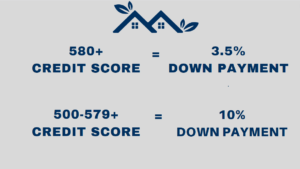

Borrowers with credit score above 580 require a 3.5% down payment. The down payment funds can be the borrowers own funds or a gift from a family member and up to a 6% seller’s concession is allowed.

If your credit score is below 580 new FHA changes require a 10% down payment. The down payment funds can be the borrowers own funds or a gift from a family member and up to a 6% seller’s concession is allowed.

Subsequently to buy a home you will need a minimum credit score of 500. FHA does not have a minimum trade line requirement and FHA allows borrowers with no credit score to qualify for an FHA loan.

Currently technology makes buying a home easier. Start the home buying processes by getting approved for a mortgage first.

When you make an offer the financing has been secured you have an actual loan approval. In fact, this gives the you more leverage and strength. According to the National Association of Realtors a home buyer will search for a property for an average of 12 weeks before writing a contract.

In other words with a formal loan approval it becomes far easier to have an offer accepted and more importantly the offer will be accepted faster. The home buyer will be more successful by securing a loan approval earlier in the home buying process.

Finally if your interested in getting a loan approval current turn time to get a loan approval is 72 hours from completing an application.