FHA Loan Guidelines 2019:

- Low mortgage rates

- First time homebuyers

- Gift for down payment

- No credit score allowed

- 500 minimum credit score

- Non occupying co-borrower

- Seller paid closing cost up to 6%

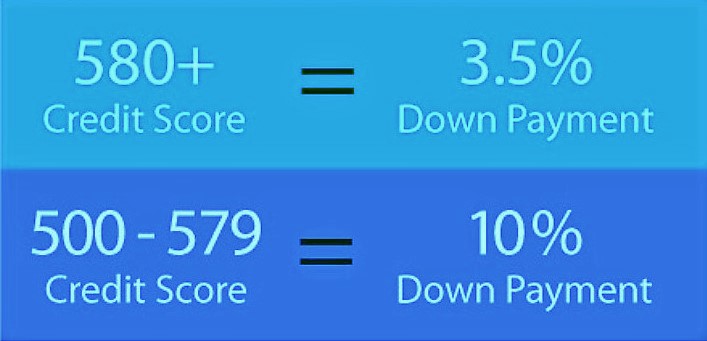

- 3.5% down with 580 credit score

FHA Loan Guidelines 2019:

FHA Loan Requirements 2019 – First of all FHA loans have been helping people become homeowners since 1934. Therefore a perfect credit score is not needed for an FHA loan approval. In fact, even if you have had credit problems, such as a bankruptcy, it’s easier for you to get an FHA loan than a conventional loan.

As a result FHA announced a set of policy changes to strengthen the FHA. The changes announced are the latest in a series of changes enacted in order to better position the FHA to manage its risk while continuing to support the nation’s housing market recovery.

Furthermore FHA requires a minimum credit score of 500. There are no income limits like you may find with first time home buyer programs. However, there are limits on how much you can borrow.

Consequently on January 20, 2010 FHA announced a new policy to address risk. As a result FHA changed the minimum credit score for new borrowers.

Finally this has allowed the FHA to better balance its risk and continue to provide financing for home buyers.

CALL US 888.958.4228

Refinance your way to a better mortgage and start saving money now. Apply online!

Let one of our mortgage professionals discuss the product that’s best for you.

535 Bergen Blvd. Suite 2

Ridgefield NJ 07657